PayPal Secures a License as a U.K Crypto Service Provider

by Oskar Trotman

Popular payment provider PayPal received its license from the Financial Conduct Authority (FCA) in the United Kingdom, recognizing the provider as a crypto asset business. The registration allows PayPal U.K. Limited to carry out crypto-related marketing in the U.K. and be compliant with the new regulatory framework. This move is part of the company’s strategy to reinstate its crypto services in the British Isles after a temporary pause. The expectations are for the payment giant to resume its crypto activities at the beginning of next year.

The biggest operational shift resulting from the FCA crypto license will be the migration of its customers from PayPal Europe to the newly established U.K. entity. Something like this was expected, considering that the U.K. left the European Union, and PayPal must adapt to the new regulatory landscape to continue providing its services and products to its UK clientele.

However, the registration does not offer a blank check to PayPal. The renowned digital wallet will have to navigate multiple restrictions of its U.K. crypto activities. The payment provider is restricted from initial coin offerings, crypto staking, and DeFi activities and is not allowed to onboard new customers or enable existing users to purchase new crypto assets without the blessing from the FCA. And PayPal’s freedoms are additionally curtailed by restricting the expansion of current crypto assets offerings.

Expanding Crypto Portfolio

Yet, PayPal’s decision to register with the FCA is not a move copied by numerous crypto firms, which have decided to exit the U.K. market. Among the big brands leaving the country is Binance, which decided to leave the UK because of compliance-related issues with the new FCA’s crypto promotion regime. PayPal is the fourth company to acquire an FCA crypto license, and the lack of competition can help the payment brand to solidify its position in the U.K.

It is worth mentioning that PayPal paused its crypto sales starting on October 1st of this year for a period of at least three months in an attempt to realign its practices and be compliant with the new regulations.

The U.K. situation is not affecting PayPal’s international operations in the crypto fintech sector. In August, the payment provider expanded its portfolio by launching PayPal USD, a dollar-backed stablecoin on Ethereum.

U.K.’s Regulatory Initiative

Since October 8, 2023, companies desiring to advertise crypto assets in the U.K. to consumers must be registered by the FCA. The regulatory agency has reported that 221 alerts have been issued in the first two weeks of October.

The U.K. Treasury published a proposal on October 31 for crypto regulation, intending to integrate crypto activities into the financial services regulation. This would empower the Financial Conduct Authority to license and regulate crypto-related companies willing to do business in the country.

The push for tighter regulation of the developing blockchain industry forced the U.K. parliament to pass a bill enabling law enforcement agencies to confiscate cryptocurrency assets used to facilitate criminal activities such as fraud, money laundering, and ransomware attacks.

Related News

Scorpion Casino Announces CEX Listing for 2024

by Oskar Trotman

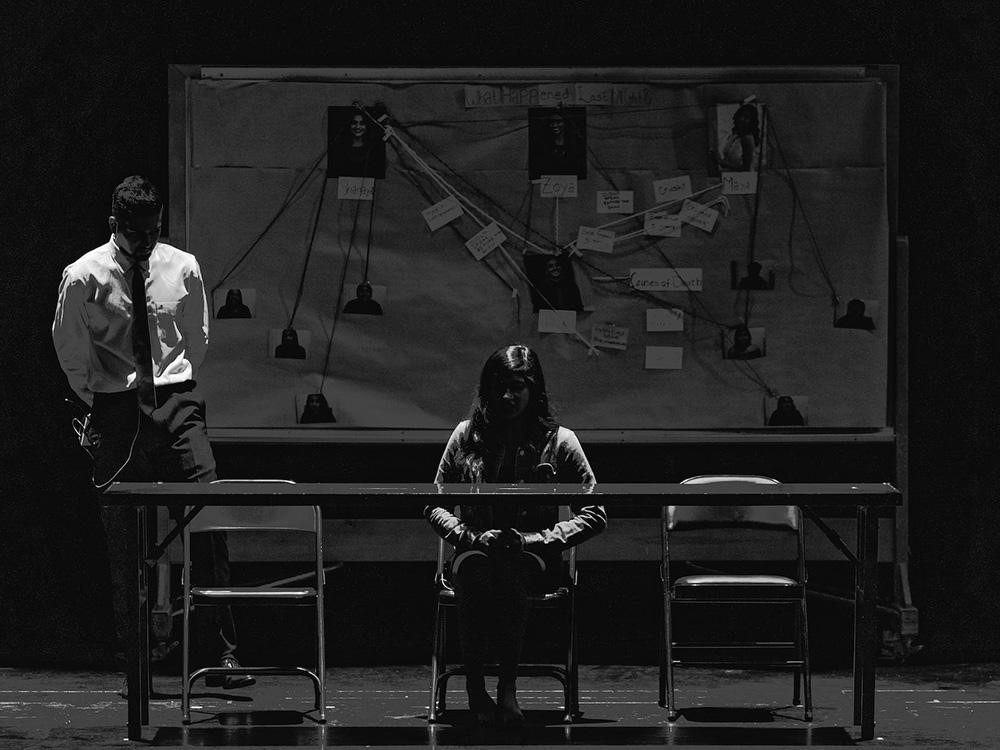

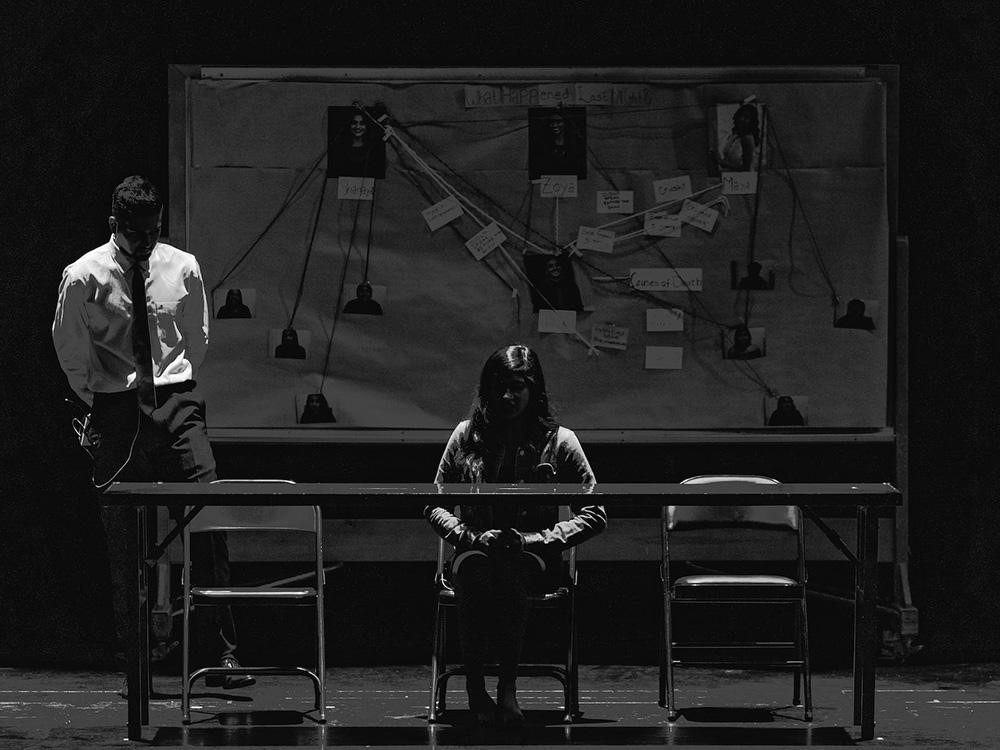

Survey Qualifies Crypto Investigations as Complex

by Oskar Trotman

Related News

Scorpion Casino Announces CEX Listing for 2024

by Oskar Trotman

Survey Qualifies Crypto Investigations as Complex

by Oskar Trotman